How to Become an Airbnb Host

summary

- Average annual profits for Airbnb hosts in the UK range from £8,100 to £20,440.

- Successful hosting hinges on a standout Airbnb profile and an inviting, well-maintained property.

- Utilise the UK's Rent-a-Room Scheme to receive the first £7,500 of rental income tax-free.

🎧 Listen Now: Sidehustles.co.uk One-Minute Podcast: How to Become an Airbnb Host.

Our Guide on How To Become an Airbnb host in the UK

Are you looking for a side hustle with quick returns? If you’ve got some web savviness and a spare room to rent, it’s high time you put these assets to work by becoming an Airbnb Host.

As an Airbnb Host, you’ll make passive income from short-term stays in your spare room or property. The profits you stand to make are potentially very high, expect to earn an average daily rate of £173 and achieve an average occupancy rate of 55%.

Being an Airbnb Host may just be the high-return opportunity you’re looking for if you’re after a quick way to make a quid or two on the side. So, how do you get in on this money-churning side hustle? Read our following guide, and by the end you’ll be renting out your spare room or property like an Airbnb pro and raking in some cold hard cash.

What Is Airbnb?

Let’s start with the basics by going into what Airbnb is.

Airbnb is an online letting platform, specifically for short-term stays. The platform enables users to find budget-friendly short-term accommodations in various locations. Meanwhile, Airbnb hosts can post their spare rooms or properties on the platform. By doing so, they make their properties available for users who need somewhere to stay for a night or two.

With millions of users making searches for accommodations, it’s no surprise hosts are making a killing on the platform. In the UK alone, annual profits for property owners can be anywhere from £8,100 yearly to as high as £20,440 per year.

What You Need To Become an Airbnb host

Before you begin making money, you need several things to kickstart your Airbnb side hustle. Here are some of the things you must have in order before embarking on your potentially lucrative Airbnb venture.

A Spare Room or Property

First, you’ll need a place to accommodate your short-term vacationers — your spare room or property.

In the UK, you can let spare rooms or entire houses for short-term stays. However, you can maximise how much you make from your short-term rental by letting a spare room within your primary residence.

Why? We’ll talk more about this later.

An Airbnb Account

A spare room or property is half the battle — the other half consists of advertising your room or property and making it available for prospective tenants, which is where an Airbnb account comes in.

Signing up for an account has become more straightforward over the years. All you need is to visit the Airbnb site, create an account, and include your pricing, property location, and, of course, pictures of your rental.

Knowledge of Rental Laws

There isn’t much difference between the rental laws of different counties. However, if you’re renting out your property or room and it’s within the Greater London Area, you’ll want to know about the 90-day rule.

The 90-day rule was a regulation passed in December 2016 and sets a limit for how long a short-term tenant stays in a property. You as a host, must ensure that your short-term tenants stay no longer than the 90-day limit.

Failure to comply with this law can result in fines that cost as much as £20,000.

The Steps on How To Become an Airbnb host

Once you have your space, account, and knowledge of rental laws dialled in, you’re ready to host. Here are the steps on how you can let your property on Airbnb.

1. Set Up Your Account

In your account, include your personal details. You’ll also want to place the location of your property or room, which will make it easier for your property to appear in searches.

2. Ensure That Your Room or Property Is Ready for Occupancy

This means carrying out the necessary repairs. Keep everything like the heating and plumbing in tip-top shape to make your property inviting for tenants. You will also want to decorate or add amenities wherever necessary.

3. Set Your Price

Setting your price is a critical part of making your property stand out on Airbnb. After all, people use the platform in search of their next budget short-term stay.

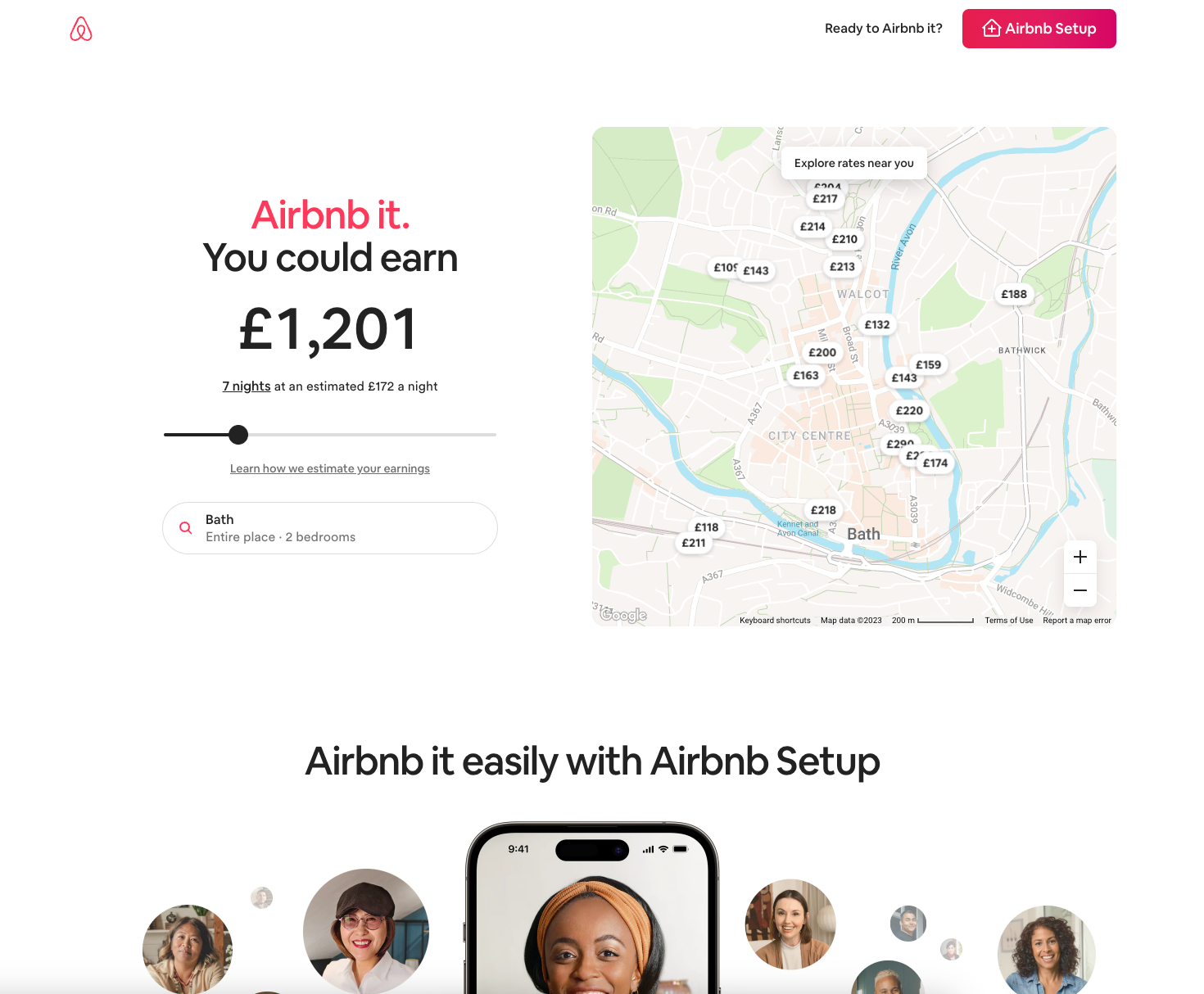

How do you determine the right rates? This is where market research comes in.

Using Airbnb, look into other properties in your area and see how much the owners charge per night, giving you a rough idea of how low (or high) you should set your nightly rates.

4. Add Enticing Photos of Your Rental on Your Airbnb Account

Vibrant photos of your rental room or property can attract visitors and prospective tenants. When taking photos, ensure that every part of your property is well-lit and visible. Doing this will help users learn about what to expect when they choose your property.

5. Set Guest Rules

Your rules can cover everything from no-shoe policies to rules about acceptable behaviour. In any case, any rules or guidelines you’d like to implement must be presented to guests upfront.

How To Minimise your airbnb Tax Liabilities

Any profit you make from your Airbnb rental is income, so HMRC will classify it as taxable.

Income taxes can be high in the UK for rental owners. Hence, you’ll likely need some strategies to maximise your profits legally.

Here are some ways to minimise your tax liabilities.

tax-free property allowance

If your annual gross property income is £1,000 or less from one or more property businesses, you will not have to tell HMRC or declare this income on a tax return.

If your property income is more than £1,000, you can choose one of the following two approaches.

Rent Out a Room in Your Area of Residence

The UK Government’s Rent-a-Room Scheme enables you to deduct the first £7,500 off your yearly taxes. To benefit from this tax cut, you’ll need to rent out a room in your primary area of residence.

Deduct Business Expenses

If the first approach doesn’t appeal to you, you can minimise your taxes by deducting your expenses. By deducting expenses on your tax return, you can reduce your taxes significantly at the end of the year. This is especially useful if you’ve paid much in the way of renovations and repairs.

To learn more about easily deducting business expenses and calculating taxes, check out my article on simplified expenses.

FAQs

is being an airbnb host a good side hustle?

Being an Airbnb Host is a lucrative side hustle that can yield high returns on your property investment. By advertising your property or room and making it inviting for prospective holiday makers, you’ll be raking in profits in no time.

So, go ahead. Take to Airbnb and make your property a money-making machine!

BEFORE YOU GO...

Before you go, consider exploring another fantastic opportunity to earn money from your home: renting out your driveway. In our next article, "Rent Your Driveway in the UK to Earn Money," we delve into how you can effortlessly turn your unused driveway space into a steady income stream. It’s an excellent alternative for those looking to maximise their property’s earning potential. Don’t miss out on this insightful guide to unlock yet another way to generate income from your home.

sidehustles.co.uk one-minute podcast

🎧 Listen Now: Sidehustles.co.uk One-Minute Podcast

How to Become an Airbnb Host.

Welcome to the Sidehustles.co.uk One Minute Podcast. In the next 60 seconds, we're sharing a real-world insight from our network of seasoned side hustlers. This quick tip is designed to offer you practical advice that you can apply immediately in your side hustle journey.

Today's tip is for those in the UK looking at Airbnb hosting as a side hustle, here's a valuable tip centred around the Rent-a-Room Scheme. This scheme allows you to earn up to £7,500 tax-free annually from renting out furnished accommodation in your own home. It's a significant benefit for homeowners. Even if you don't delve into the full article, it's crucial to know that by renting out a spare room in your main residence, you can utilise this tax relief. This approach boosts your income without increasing your tax liability. Particularly for new hosts, this tip is invaluable for maximising earnings from your Airbnb venture while keeping tax complications to a minimum.

That's your one-minute real-world insight. Stay tuned for more!

ARTICLE SOURCES

https://www.sidehustles.co.uk/rent-out-a-room-in-your-home-to-earn-money

https://airbtics.com/is-airbnb-profitable-uk/

https://www.linkedin.com/pulse/how-much-can-you-earn-renting-your-apartment-airbnb-uk-shah-karim/

https://www.lettingsowl.co.uk/post/is-airbnb-profitable-in-the-uk-for-hosts

share this article

WHAT ARE OTHER PEOPLE READING?