How to Raise Funding for Your Side Hustle

summary

- Explore SEIS for tax-efficient investor funding in the UK.

- Craft a solid business plan which is essential for investor appeal.

- Avoid high-interest debt; prioritise strategic funding choices.

🎧 Listen Now: Sidehustles.co.uk One-Minute Podcast: How To Raise Funding for Your Side Hustle.

How to Raise Funding for Your Side Hustle in the UK

Whether you’re starting an online shop or a lawn mowing business, establishing a side hustle will require resources. You will need funding to source your products, buy equipment, market to an audience, and so on. A lack of monetary resources can hinder you from starting the side hustle or achieving your goals. Fortunately, there are ways to get the money you need, and below is a guide on how to raise funding for your side hustle. Keep reading and apply the tips we’ve included!

Where To Look for Funding

There are many places in the UK where you can access financing for your side hustle. Here are some of the most popular options:

Angel Investors

Angel investors are a blessing, if we may say so ourselves. These are the investors who mainly work with start-ups and small companies, offering “seed” or “angel” funding to help your venture begin. In exchange, the investor gets a “piece” of the business, which could come in the form of equity or royalty. An angel investment could happen at a stage when the business is only an idea, but it could also come when you’ve already started and are in need of additional funding.

To find angel investors, you can try visiting websites like AngelList and LinkedIn. Angel investor networks also exist in real life, and you can find them at company events, through word of mouth, or by asking other start-up businesses at your

local business hubs.

Loans and Grants

Bank loans

Many banks and co-ops in the UK have established borrowing programs where aspiring entrepreneurs can get funding.

One popular option is Start Up Loans. These are personal loans that have been specially designed to help new businesses start their operations. These loans were created to provide support to aspiring business owners who have faced difficulties in obtaining assistance from lenders.

To date over 100,000 small enterprises have been granted loans aimed at helping them expand their activities. The Start-Up Loan program was launched by the government in 2012 and is administered through the state-owned British Business Bank. Its purpose is to assist early stage businesses in the UK that lack funds or support from friends and family to access financing and mentoring.

Before applying or signing the loan, make sure to understand the terms and conditions. Knowing what you’re signing into can help protect you from future financial strain.

START-UP grants

In addition to loans, the UK offers a variety of startup grants, invaluable for funding your side hustle without the burden of repayment. These grants are typically sector-specific or regionally focused, providing financial support to innovative and growth-oriented startups.

Organisations like Innovate UK offer grants for technology-driven businesses, while local government schemes often support regional economic development. It’s crucial to research eligibility criteria as these grants can be competitive and target specific types of businesses or objectives. Utilising grants not only bolsters your financial resources but also adds credibility to your venture, attracting further investment.

Check out the following web links to organisations offering grant services

UK Government Find a grant: https://www.find-government-grants.service.gov.uk

Grants Online: https://www.grantsonline.org.uk

Turn2us Grants Search:

https//grants-search.turn2us.org.uk

Friends and Family

Some people may discourage you from “doing business” with your family or friends because this practice can harm relationships. However, you may be surprised by the people who are willing to lend a hand. You can avoid possible conflicts of interest by being savvy with your business plan and by having transparency about potential risks with the business.

Drawing up an agreement is often advisable. Once a friend or family accepts, they can provide funding much like an angel investor would.

Drawing up a loan or investment agreement is often advisable, even for family and friends. You can use a solicitor to do this, or you can download a free template online, an example can be found here: https://www.legalcontracts.co.uk/contracts/loan-agreement-forms/

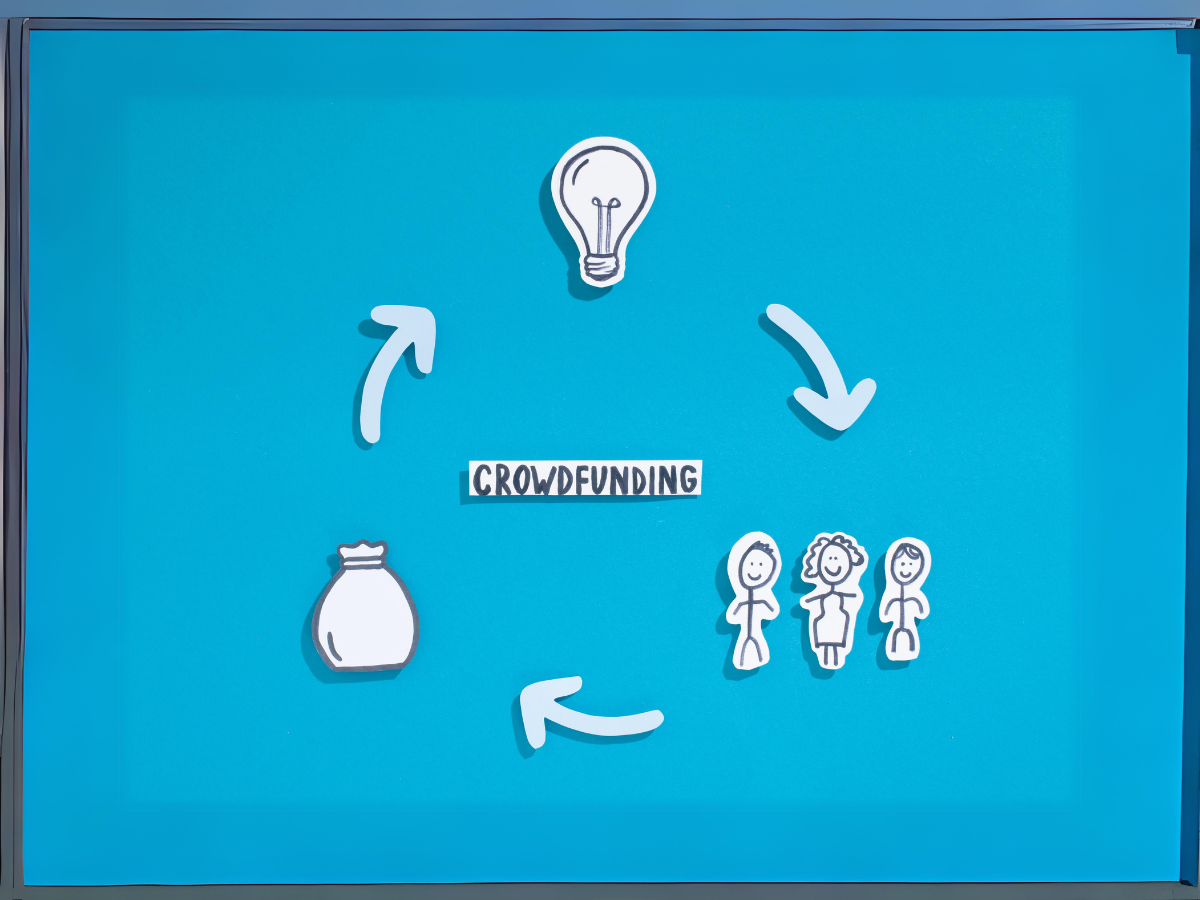

Crowdfunding

You can tap into a wider market and raise funds via crowdfunding. Sites like GoFundMe and Indiegogo allow you to present your ideas and gain supporters who can provide small amounts until you reach the target capital.

To fully take advantage of crowdfunding, you’ll need to have a compelling reason why people should support your side hustle. In addition, you have to offer rewards to those who actually send funding, such as early-bird pricing or discounts. Those who donate don’t have to become partners or buy shares — you just have to find a way to acknowledge their contributions.

How To Make Your Side Hustle Investment Ready

The common aspect of most of the sources we shared above is that someone will have to invest in your company. This fact requires you to make your investment ready so that possible contributors can be more confident about the money they’re going to give. So, whether you’re starting a dropshipping business or courier franchise, being investment-ready is necessary. Here are a few things you can do.

Work With an Accountant

One of our most important recommendations is working with a qualified accountant, especially if you have big plans to eventually grow your side hustle. Accountants can help you manage most of the financial aspects of your business, from keeping records of transactions to handling tax obligations. Having an accountant is key to an organised financial structure, which attracts investors.

Apply for the Seed Enterprise Investment Scheme (SEIS)

SEIS is a UK government program that offers tax incentives for investors that focus on start-ups like yours. You can receive up to £250,000 from investors under this scheme, so make sure to check out SEIS as you begin your side hustle.

Write a Business Plan

A well-crafted business plan is fundamental in presenting your vision, strategy, and financial projections to potential investors and lenders, crucial for those aiming to expand their side hustle. This document should be comprehensive, reflecting your deep understanding and thorough planning. Key elements to include are:

Target Market

Clearly define your target audience. Include demographic details, purchasing behaviours, and specific needs your side hustle aims to meet. Understanding your market is critical for tailoring your product or service effectively.

Competition

Analyse your competitors. Detail who they are, their market share, and their strengths and weaknesses. This analysis not only highlights your understanding of the market landscape but also how your side hustle differentiates itself.

Revenue Model

Elaborate on how your side hustle will generate income. Will it be through direct sales, subscription models, advertising, or a combination of these? Clarifying your revenue streams will help investors see the viability and scalability of your business model.

Growth Strategy

Outline your strategy for growth. This could include plans for scaling operations, marketing tactics to increase market penetration, or product development for diversification. Investors want to see that you have a realistic and sustainable plan for growth over time.

Including these detailed aspects in your business plan demonstrates a well-rounded and strategic approach, significantly increasing your side hustle’s appeal to potential investors.

free business plan template

The Prince's Trust is a UK charity supporting young people with training, mentoring, and funding to start their own businesses. They offer a free business plan template you can download at their website here:

https://www.princes-trust.org.uk/how-we-can-help/tools-resources/business-tools/business-plans

Forecast Your Finances

Having a clear picture of your financial outlook is important for investors as these projections help them decide whether they want to commit to your budding side hustle or not. Make sure to create a realistic forecast and include details like projected revenue, expenses, and profitability.

If you use accounting software for your side hustle such as Xero, or QuickBooks, these will be able to produce detailed projections and forecasts for you. If you have an accountant, they will also be able to assist with this.

Focus on Traction

Traction is your business’ momentum, and it can be shown in various aspects. Showing off this steady growth, whether it’s your revenue or customer engagement, encourages investors and shows them that your venture has a high potential for success. Investors are more likely to invest if they see quantifiable proof of your steady growth.

Coupled with this advice, one of our personal favourite business books, funnily enough, called 'Traction' by Gabriel Weinberg and Justin Mares, offers invaluable insights into gaining and managing business momentum effectively.

Funding Pitfalls to Avoid in Your Side Hustle Journey

While exploring funding options for your side hustle, it’s equally crucial to be aware of certain pitfalls that can jeopardise your financial stability and business growth. Here are some key missteps to avoid:

High-Interest Debt

Steer clear of funding your venture through high-interest credit cards or loans. Such debts can quickly spiral out of control, making it harder to achieve profitability.

Unregulated Lenders

Avoid unregulated or informal lenders. Their lack of legal oversight often translates into exorbitant interest rates and predatory terms, posing a significant risk to your financial health.

In the UK, you can check if a lender is regulated by referring to the Financial Conduct Authority (FCA). The FCA maintains a comprehensive register of all financial services firms, individuals, and other bodies that are, or have been, regulated by them.

You can search the FCA register here: https://www.fca.org.uk/firms/financial-services-register

Equity Overcommitment

Be cautious about how much equity you give away. Excessive dilution of your ownership early on can lead to reduced control over your business decisions and diminished returns in the future.

Ignoring the Fine Print

Always read and understand the terms and conditions of any funding agreement. Neglecting the fine print can lead to unfavourable conditions that may hinder your business’s flexibility and growth.

Consider consulting a solicitor to review contracts, ensuring legal accuracy and protection for your business interests.

You can search for a UK solicitor at the Law Society website: https://solicitors.lawsociety.org.uk/

Mixing Personal and Business Finances

Using personal savings or assets without a clear strategy can risk your personal financial security. It’s important to maintain a clear boundary between your personal and business finances.

Over-Optimism in Financial Projections

Be realistic with your revenue forecasts. Overestimating your financial performance can result in being under prepared for the actual capital required, leading to potential cash flow issues.

Remember, the key to successful funding is not just about securing resources but also about making informed, strategic decisions that safeguard your side hustle’s long-term viability.

FAQs

final thoughts

There are plenty of ways you can source funding for your side hustle, from taking out loans to working with angel investors. The most important thing you have to consider is making your start-up business investor-ready, which helps ensure that investors will find your new venture worth the backing. Follow the tips we shared above to increase your chances of securing funding.

BEFORE YOU GO...

Securing funding for your side hustle is a vital step in your entrepreneurial journey. However, the road doesn't end there. As you navigate through the complexities of managing a growing business, you'll encounter a number of financial decisions, each pivotal to your success.

Up next, we delve into another critical question: "Do You Need a Business Bank Account?" This is more than just a matter of financial organisation; it's about making strategic choices for the efficiency and growth of your business. Our forthcoming article will provide you with insights and guidance on when and whether a dedicated business bank account is required and how it can benefit your side hustle.

sidehustles.co.uk one-minute podcast

🎧 Listen Now: Sidehustles.co.uk One-Minute Podcast

How to Raise Funding for Your Side Hustle.

Welcome to the Sidehustles.co.uk One Minute Podcast. In the next 60 seconds, we're sharing a real-world insight from our network of seasoned side hustlers. This quick tip is designed to offer you practical advice that you can apply immediately in your side hustle journey.

Today, we're looking at How to Raise Funding for Your Side Hustle. A standout tip from our network of side hustlers is to explore the Seed Enterprise Investment Scheme. This UK government initiative offers significant tax reliefs to investors who back your business, making your venture an attractive investment option. It’s not just about gaining funds; it’s about smart funding. SEIS not only helps you raise capital up to £250,000 but also builds investor confidence, giving your side hustle a substantial financial and credibility boost right from the start. This approach is a game-changer for many startups and could be the key to unlocking your side hustle's potential. Remember, securing funds is one thing, but doing it wisely sets the foundation for your business's growth and success.

That's your one-minute real-world insight. Stay tuned for more!

share this article

WHAT ARE OTHER PEOPLE READING?